Rize

By: Kye Li Chia, Ahmad Arief, Faizul Azmi

Project Partner:

Oliver Wyman, Al Rajhi Bank, Rize

My Responsiblities:

For Rize's digital bank, I collaborated with Oliver Wyman consultants, crafting user-friendly interfaces (wireframes & visuals) and a cohesive design system. I co-developed intuitive user flows based on research and feedback, and played a key role in user testing (moderator guide, prototypes, facilitating sessions). Utilizing Jira, I managed design tasks and ensured seamless collaboration with developers.

Background

User Journeys

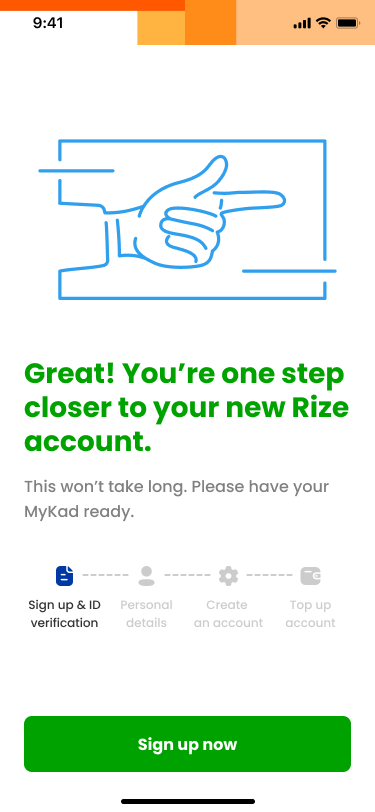

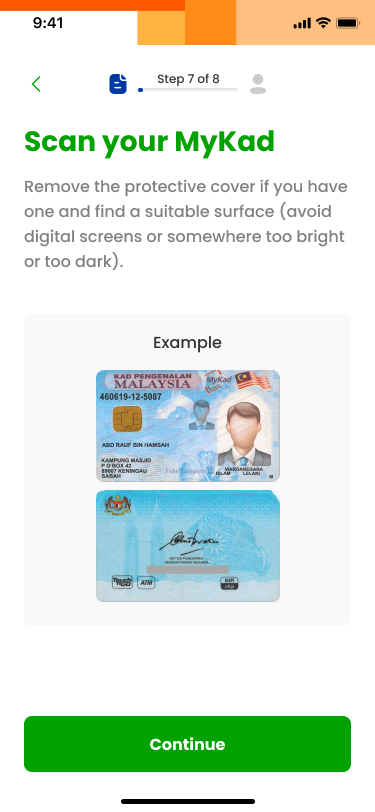

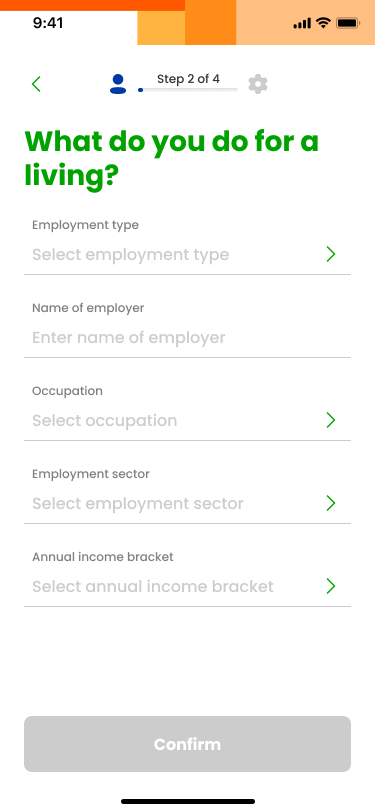

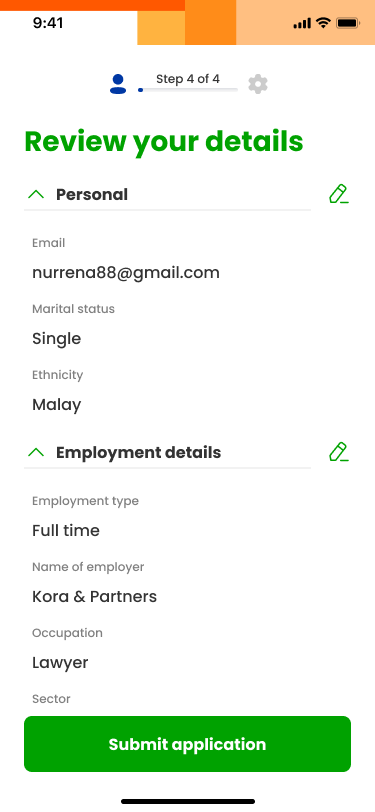

Onboarding:

The Rize onboarding process is designed to streamline the user experience, enabling them to complete it swiftly. Through eKYC verification, users can verify their identity and onboard within minutes, ensuring a seamless journey.

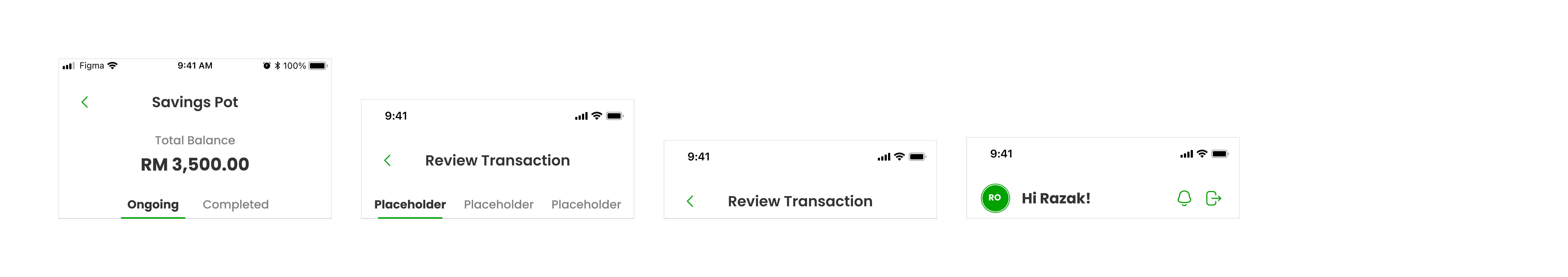

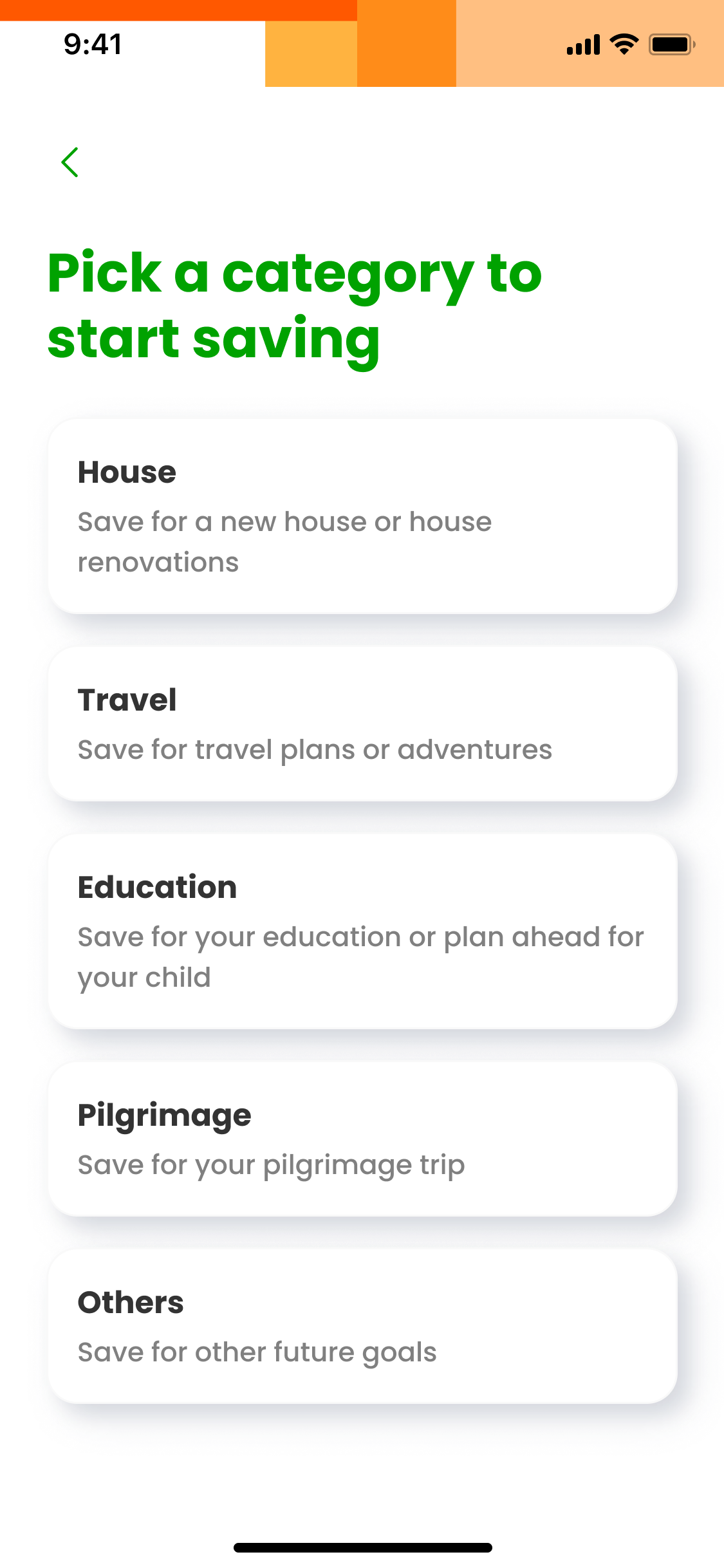

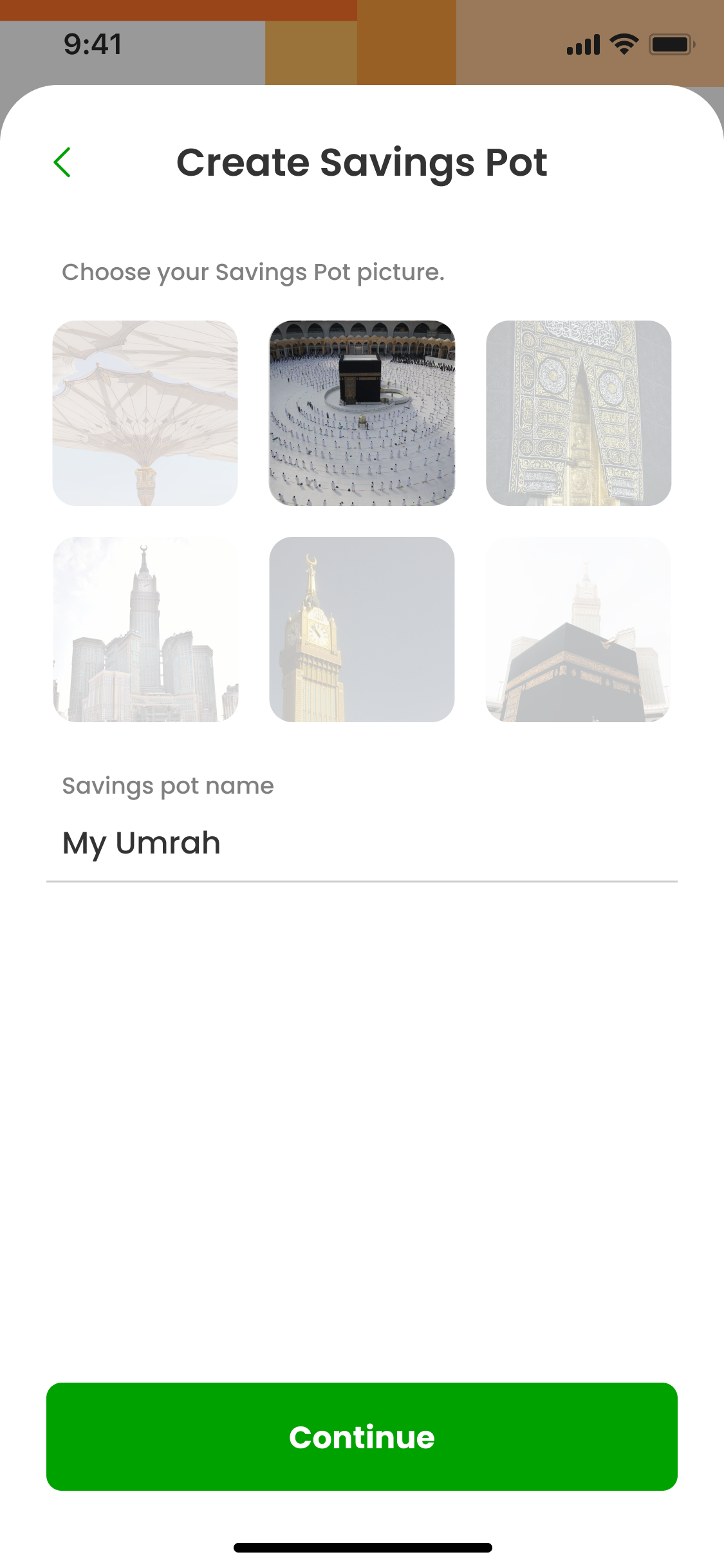

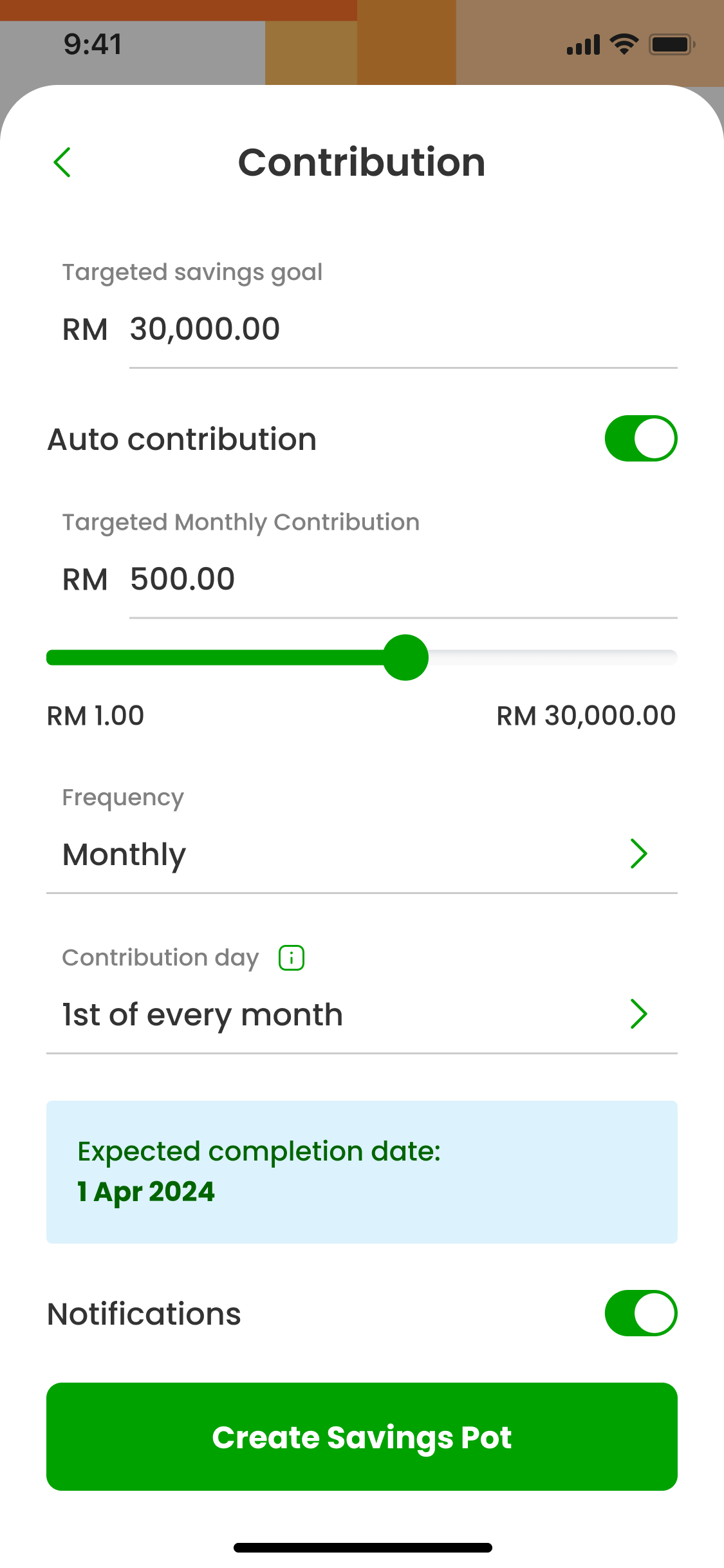

Savings Pot:

The Rize Savings Pot empowers customers to work towards their savings objectives. Offering the flexibility for multiple contributions, customers can involve their family and friends, boosting progress towards mutual goals.

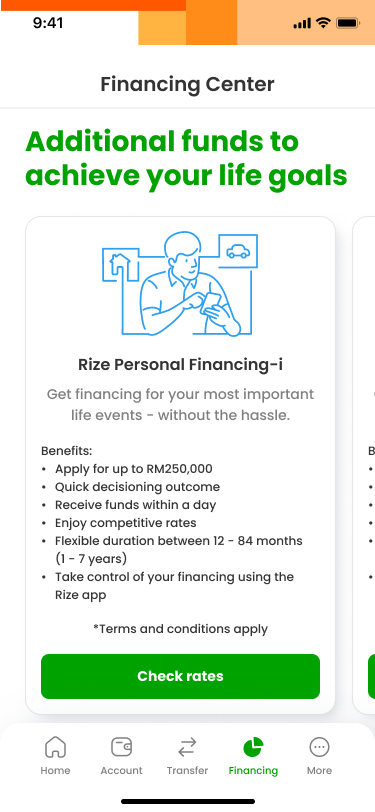

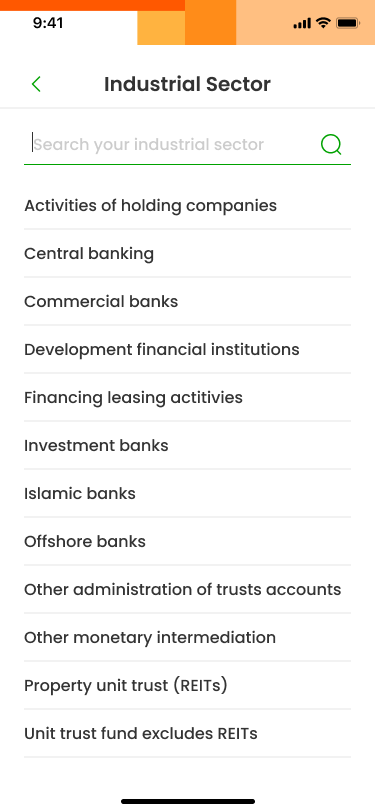

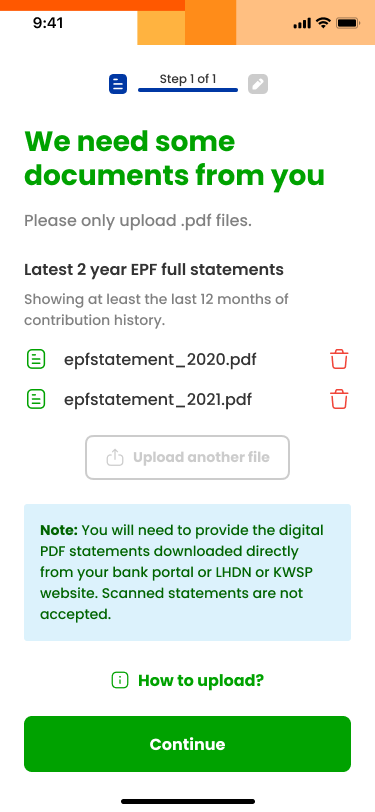

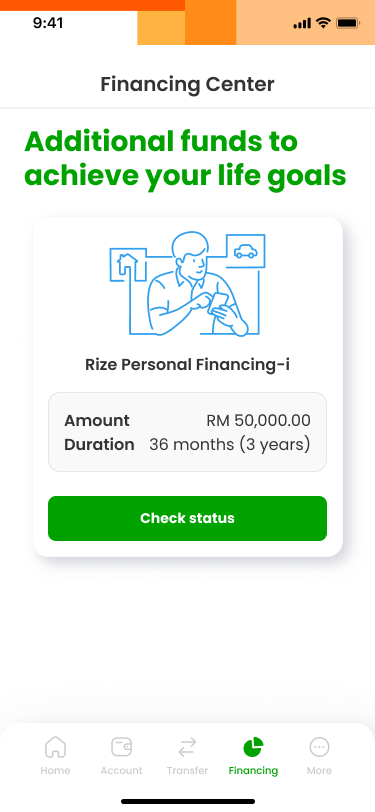

Personal Financing:

Although Rize presently caters primarily to retail customers, the digital bank has its sights set on the small and medium-sized enterprise (SME) segment. The application process for Personal Financing-i by Rize involves just four simple steps, with funds deposited into the customer's account within 15 minutes.

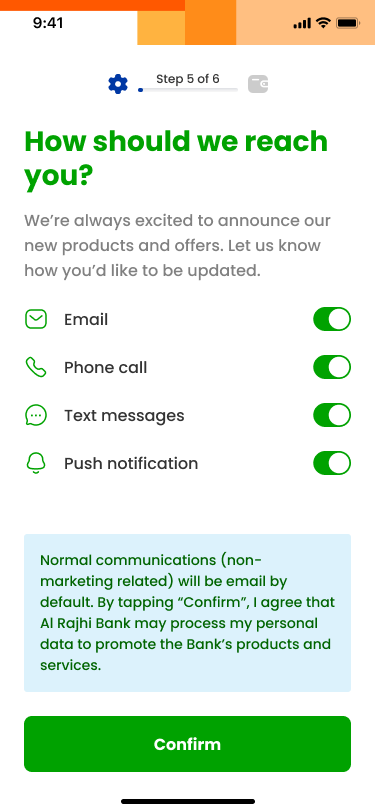

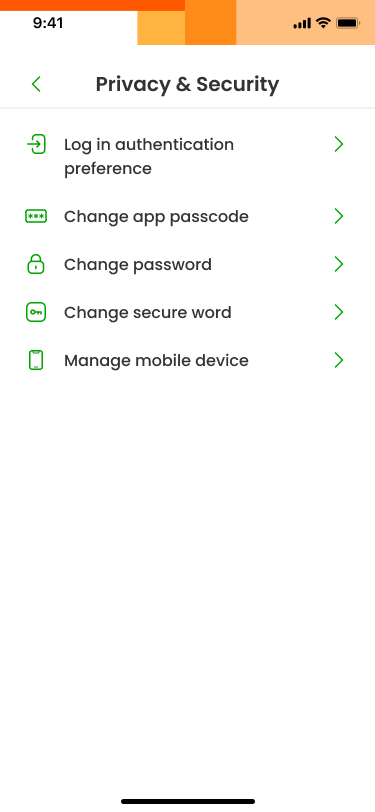

Settings:

Customers have full control over managing their personal details, privacy, and security, as well as their card settings, payment preferences, and communication options within the application's settings. Additionally, they can easily access customer care and their important documents through this section of the application.

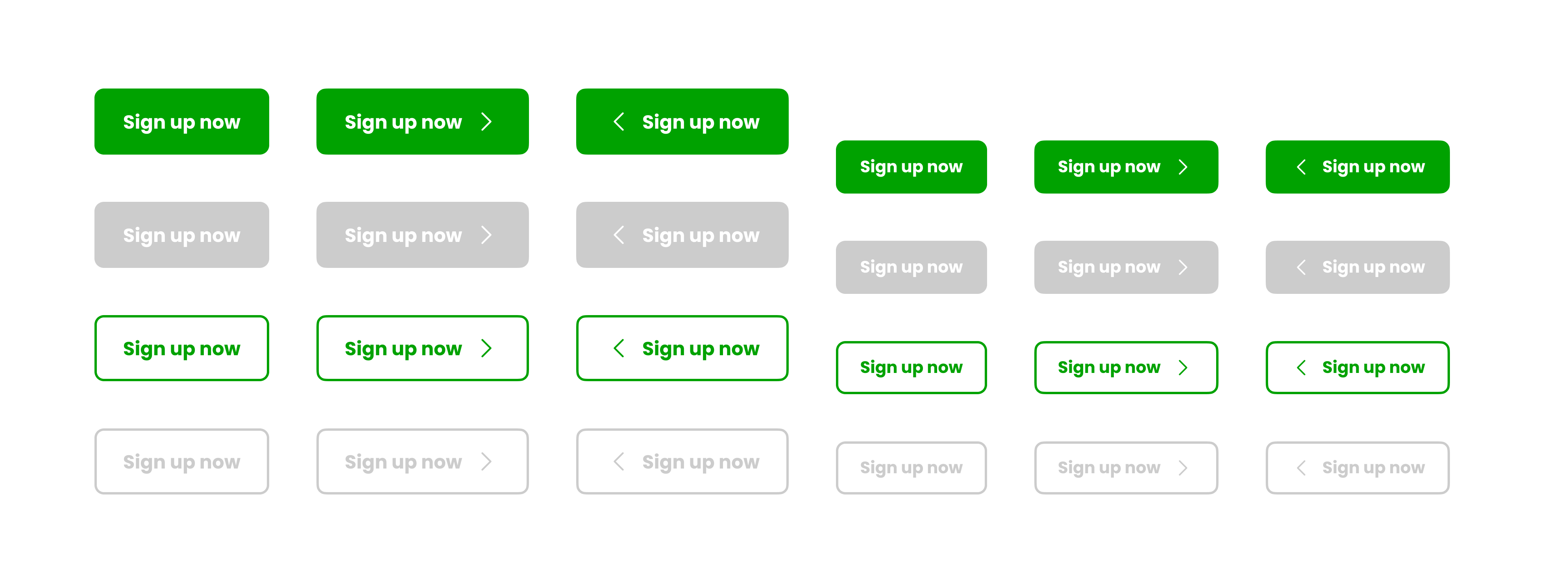

Design System